It is an unsettling time for many of our partners and customers, particularly those leveraging VMware technologies such as VDI and server virtualization, with uncertainty of Broadcom’s plans after their recent acquisition of VMware and likely changes to licensing costs, SKUs, product availability and so on.

Update: Nov 2024: Chris Evans, Principal Analyst with Architecting IT posted some interesting comment and data on Nutanix financials indicating increased deployment via Nutanix AHV vs VMware (2) Post | LinkedIn.

Update: June 2024 – HPE Enters the Virtualization Market – The Futurum Group – how HPE have indirectly become a competitor to VMware. Updates: May 2024 – a link to: VMware booted from Treasure Island: Nutanix hits jackpot with CIO (thestack.technology) and a link to VMblog.com article from NetApp’s Matt Watts(Virtualization Uncertainty: 4 Key Challenges for VMware Customers and How to Navigate : @VMblog). April 2024 with details of the VMware EUC division’s new life as Omnissa – Introducing Omnissa, the former VMware End-User Computing business – VMware End-User Computing Blog

Against a background of recent wider global disruption to financial markets, economies and IT – depressing stuff like – conflict, energy prices, interest rates; Broadcom’s changes at VMware haven’t come at the best time and many of our customers and partners are having to evaluate their options.

Today, I’ll be covering what is known about Broadcom’s plans for VMware and how those likely to be affected can mitigate against risks and possible long-term strategies that will empower our customers and partners to proactively take control of their IT futures regardless of Broadcom’s plans for VMware.

Understanding Broadcom’s Plans for VMware

Friday 2nd February 2024 marked a cutoff as the last day to purchase existing quotes and renew current SKUs for VMware customers. Effective of Monday 5th February 2024 for new renewals and new purchases the options for buying VMware technologies have dramatically changed. For those in EUC especially key changes include:

- vSphere Enterprise Plus (Enterprise+) customers must transition to bundled per core subscriptions such as VMware vSphere Foundation or VMware Cloud Foundation

- Many standalone products have become EOA (End of Availability), as detailed in VMware End Of Availability of Perpetual Licensing and SaaS Services – VMware Cloud Foundation (VCF) Blog – note this article replaces the widely circulated KB96168 VMware Knowledge Base article. Notably EUC focused products such as vSphere for Desktops and vSphere ROBO (Remote Office/Branch Office) are no longer available

- Broadcom have announced they will be divesting the VMware EUC (which includes the Horizon VDI/DaaS products) and Carbon Black businesses, see: A New Dawn For VMware EUC And Carbon Black Brings Risk (forrester.com). Update 26/Feb/2024 – The official announcement that KKR has entered into an agreement to acquire the EUC division – End-User Computing Division of Broadcom embraces its future as a standalone business – VMware End-User Computing Blog. April 2024 details of the VMware EUC division’s new life as Omnissa are now available including some on the bundling of vSphere + Horizon, see – Introducing Omnissa, the former VMware End-User Computing business – VMware End-User Computing Blog. (Update Aug/2024 – It seems Carbon Black stayed with Broadcom and got merged into the Symantec security division – see: Broadcom Merges Symantec and Carbon Black Into New Business Unit – SecurityWeek).

- Broadcom seem to be effectively reducing or significantly changing large parts of their channel and partner programs – VMware customers face uncertain future as Broadcom ends VMware partner programs | Ars Technica.

- Aria SaaS, a cloud version of VMware’s Aria monitoring management tools (which were previously sold under the “vRealize” brand) has been killed, see: Amid subscription push, VMware killed a SaaS product • The Register.

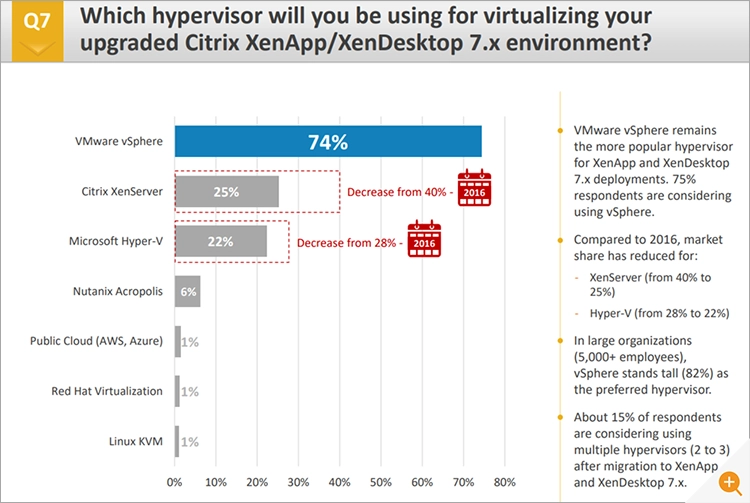

Many Citrix Customers will be Impacted by the Changes at VMware

vSphere / ESXi is widely regarded as a gold standard in enterprise hypervisors, rock-solid and reliable – nobody ever got fired for buying ESXi. It’s one of the most widely used hypervisors used to deliver Citrix apps and desktops, with many customers preferring to pay extra rather than rely on the free Citrix Hypervisor (was and now again called XenServer) bundled with Citrix’s VDI offerings. (Note: Changes at Citrix mean that it is very possible that future versions of XenServer will no longer be bundled for free with CVAD products and the upcoming XenServer 8.2 release may require paid for licensing).

Citrix customers running on vSphere are very concerned that the changes will lead to significant cost increases. There has been a lot of analyst discussion around this and evidence that this something businesses are taking extremely seriously:

- Broadcom’s VMware acquisition brings surprising consequences — how to prepare (sdxcentral.com) notes how the vSphere Enterprise+ changes mean that the product is now available only in a bundle with vSAN and vRealize licenses, meaning vSphere customers could see their costs double or triple as a result.

- At E2EVC in November 2023, an architect described how they were towards the end of a project to migrate 75k VDI users off ESXi to Microsoft’s Azure cloud. Interestingly, a project instigated by senior management’s reaction to a Broadcom quote for their renewal, quite a while before the recent press and announcements.

- This Reddit thread with 300+ replies is a good overview of the concerns of the VMware user community, see: What Hypervisor alternatives is everyone looking at? : r/vmware (reddit.com).

- EUC Slack is full of questions such as “Anyone using vSphere for Desktop licensing? Seems Broadcom got rid of the SKUs and we’re left with two options now: 1 – move to the Citrix hypervisor, 2 – move to Horizon VDI which includes the vSphere hypervisor for desktop as part of the Horizon Universal Subscription”. Others are debating alternatives such as Nutanix, Proxmox, Hyper-V, Azure HCI, AWS Outposts, public cloud and many others.

- Nutanix with their capabilities to run vSphere in parallel with their own AHV hypervisor in both cloud and on-prem scenarios and also in non-VDI server virtualization use cases, potentially stand to gain and are running various promotions, see VMware to Nutanix Migration Promotion and 9 Predictions for VMware Users of Unexpected Broadcom Consequences (nutanix.com). Obviously not exactly impartial reporting. (Update May 2024 – Nutanix seem to be marketing some success with their positioning as an alternative to vSphere – see: VMware booted from Treasure Island: Nutanix hits jackpot with CIO (thestack.technology) Oracle too are socializing their ability to host VMware on the Oracle Cloud, see: Announcing the Oracle Cloud VMware Solution spring release with new flexible standard shapes. Whilst Azure HCI is also being discussed as potential on-prem alternative to vSphere by some, see: Reduce risk from Broadcom acquisition with VMware alternatives (morpheusdata.com).

Nobody likes forced change!

VMware customers are looking at their options for many reasons:

- The prospect of genuine steep increases in their VMware licensing costs. Leapfrog (A Managed IT Service Provider) published some data in January 2023 on the likely costs to their clients of various sizes, plus some information on the possibility of exemptions whereby certain clients may still be able to purchase perpetual licenses, see: Blindsided by VMware? How To Regroup and Come Out Ahead – Leapfrog Services

- They don’t like being at the mercy of Broadcom’s whims

- Many receive high-quality support from the channel partners and having to deal directly with VMware for support may be a less appealing product

- Everyone else is so they feel they need to do so too

Update Jun 2024: An interesting article and video from Keith Townsend, on how HPE Greenlake is being evaluated in some organizations as an alternative to vSphere. HPE are one of Broadcom’s closest partners and certainly aren’t pushing this directly, but forced change creates interesting dynamics… see: HPE Enters the Virtualization Market – The Futurum Group.

Update May 2024: A nice measured, overview article from NetApp’s Matt Watts on the choices facing VMware customers and approaches that many are taking – see: Virtualization Uncertainty: 4 Key Challenges for VMware Customers and How to Navigate : @VMblog.

For some staying with VMware (or at least for now) may be the best choice, but they must evaluate that. For those who decide to stay for now they are looking to ensure that their VMware environments are optimized and right-sized to minimize licensing requirements and exposure to licensing price increases.

The more measured analysts recognize VMware will remain the most pragmatic option for some use cases, for details see: Broadcom’s VMware acquisition explained: The impact on your IT strategy | Computer Weekly. A significant bar to migration in many organizations will be a lack of skills and expertise with alternative technologies. Back in Nov 2023 (prior to a lot of the specific details of change being announced – particularly the channel impact), it was reported that 20% of VMware users were looking to migrate away – 20% of Users Looking to ‘Escape’ to VMware Alternatives (channelfutures.com).

Broadcom / VMware have themselves tried to reassure their customers that there are positives to the changes, see: VMware by Broadcom Dramatically Simplifies Offer Lineup and Licensing Model – VMware News and Stories. William Lam from VMware/Broadcom has released some very useful tools and articles that will help VMware customers assess future costs and whether customers have a reason to be concerned or whether the reporting is a bit over-hyperbolic, see: Automating counting cores & TiBs for new VMware vSphere Foundation (VVF) and VMware Cloud Foundation (VCF) SKUs (williamlam.com).

Many users feel they don’t have enough information to make a judgement yet and a few are mooting potential benefits from the changes, see: What if everything isn’t horrible… : r/vmware (reddit.com).

A decision point for many may well be the not-to-distant April 2025 EOL date for ESXi 7.0. With migration paths to plan many are likely to hold off rushed decisions and remain with Broadcom for now – whilst incorporating the effects of the changes into their ESXi / vCenter EOL plans next year.

VMUG Community Thoughts on Broadcom’s Plans for VMware

On Feb 2, 2024, VMUG (VMware User Group) held a Town Hall Webinar meeting, the chat throughout the call was somewhat brutal with many trying to get updates on Broadcom’s plans. The meeting was really designed to update VMUG members with what they know of Broadcom’s plans and how it will affect VMUG as an independent group and programs such as VMUG Advantage especially when the EUC products are spun out / sold off.

Whilst not entirely constructive the chat did give an indication of where pain points may be and answer some questions about what will be bundled with what. There were concerns that DVS (Distributed Virtual Switch) may be part of the VCF only – I haven’t managed to find any published information to confirm and switches seem absent from the official Broadcom lists at the moment (Update: within a few minutes of publishing this article, a community member reached out and pointed me at this VMware datasheet which indicates that VDS falls under vSphere Foundation – see https://www.vmware.com/content/dam/digitalmarketing/vmware/en/pdf/docs/vmw-datasheet-vsphere-product-line-comparison.pdf). It was also clarified that Workstation and Fusion are VCF products and would remain Broadcom products (If I recall correctly, these teams were transferred from the EUC division to vSphere in around 2016).

Another Town Hall is scheduled in a few months and will probably be worth attending – one to watch out for. Update 26th Feb 2024: The registration link for upcoming VMUG town halls on March 1st and March 4th 2024 are now released, see: Webinar Registration – Zoom.

Ways eG Enterprise Can Help – Data Led Decision Making

Our comprehensive monitoring and observability platform offers an agnostic, independent single pane of glass to help you make decisions around your VMware landscape. With eG Enterprise you can:

- Understand your current VMware usage and future capacity requirements. A wealth of out-of-the-box live and historical reports designed for key stakeholders for all your VMware also non-VMware technologies to understand every aspect of your application and infrastructure usage

- Compare both the performance and costs of alternative solutions. Hypervisors are not equal and HCI behaves very differently to vSphere under many workloads – compare what performance you actually will see.

- If you do choose to migrate, benchmark before and after to evaluate success.

- A single product that can monitor VMware alongside alternative and dependent technologies. eG Enterprise supports a vast range of alternatives stacks VMware customers may be evaluating in a single console – whether that’s AWS, Azure, Nutanix, XenServer, AVD, Proxmox, OpenShift, Kubernetes and more.

The somewhat over dramatic reporting and large number of parties with vested interests commenting is unsettling for VMware users, with good monitoring data and analytics though businesses can take control of the situation and make sensible decisions based on data and facts vs hype and opinion.

Key Features for a VMware Evaluation or Monitoring Strategy

eG Enterprise is a particularly good fit for answering the questions facing VMware customers at the moment and for any steps they may take to change their vendor dependencies. Differentiators over alternative monitoring options include:

- Support for over 500+ applications and infrastructure technologies beyond VMware. Details of everything we can monitor are available here: End-to-End Monitoring: Applications, Cloud, Containers (eginnovations.com).

- Transferable licensing. Licenses for eG Enterprise can be transferred alongside users and workloads in migrations. Details included here: How eG Enterprise IT Monitoring Licensing is Cost-Effective and Flexible | eG Innovations.

- On-prem, in cloud or as secure SaaS. Many vSphere customers have on-prem requirements, and we are committed to supplying an equivalent eG Enterprise platform for on-prem usage as is available in cloud or as SaaS.

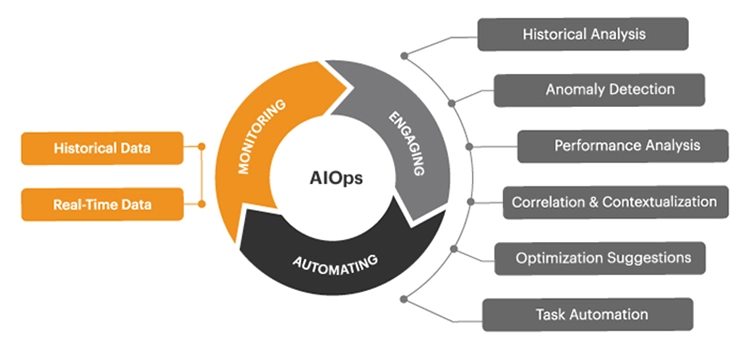

- Out-of-the-box AIOps, metric thresholds, alerting and more. Some of the migration options vSphere customers may be considering are very different to vSphere’s architectural model and scale in very different ways. VMware administrators face a steep learning curve and significant manual setting and tuning if they do not use tools that are configured out of the box with domain aware alerting.

- Full-featured multi-tenant support with MSP friendly licensing. For CSPs or MSPs affected by changes at VMware we have the features that will support them evaluating alternatives.

- Easy to use with automated root-cause analytics. Troubleshooting application performance issues in a Nutanix HCI environment is very different to an on-prem vSphere one. eG Enterprise can help ease such migrations particularly in organizations where staff skillsets are currently VMware focused.

Learn More

There’s a huge amount of news and discussion around the changes at VMware, some of the most insightful I found include:

- Broadcom Is Making Shareholders Rich, Rivals Happy And VMware Partners Bitter (crn.com)

- Why Broadcom Is Killing off VMware’s Standalone Products – The New Stack

- Are there realistic alternatives to VMware?

For information on eG Enterprise monitoring for:

eG Enterprise is an Observability solution for Modern IT. Monitor digital workspaces,

web applications, SaaS services, cloud and containers from a single pane of glass.

- Virtualization: Virtualization Monitoring | eG Innovations

- Nutanix: Nutanix Monitoring for Nutanix AHV Performance (eginnovations.com)

- VMware: VMware Monitoring Tools | eG Innovations

- Citrix: Citrix Monitoring Tools | eG Innovations

- Microsoft AVD: Azure Virtual Desktop Monitoring | eG Innovations

Rachel has worked as developer, product manager and marketing manager at Cloud, EUC, application and hardware vendors such as Citrix, IBM, NVIDIA and Siemens PLM. Rachel now works on technical content and engineering and partner liaison for eG Enterprise

Rachel has worked as developer, product manager and marketing manager at Cloud, EUC, application and hardware vendors such as Citrix, IBM, NVIDIA and Siemens PLM. Rachel now works on technical content and engineering and partner liaison for eG Enterprise